An old friend has an expression “He was that happy that 10 lemons couldn’t wipe the smile off his face”.

Here’s a photo of Peter Thornhill ‘drowning in dividends’ as we near the end of FY12 dividend season. What a smile!

Peter has kindly penned a very timely, and as always, an extremely powerful piece sharing with us his sure fired conservative way to a ‘Safe’ retirement for his wife Frieda and himself… 90% shares!

Over to you Peter…

“As we transition to full retirement we decided to take charge of our future and opted some years ago, with the assistance of our financial advisor, to manage our own super. One of the primary reasons for this was to ensure that the assets reflected our very conservative nature; that is 90% shares. This may sound contradictory to many but after 45 years in the financial services industry I had learnt some very important lessons.

The word ‘risk’ is bandied about but many do not truly understand the investment risks associated with retirement. Leaving it to an industry that also doesn’t understand it did not appeal to us. Our primary risk is not the volatility of our asset base or ‘losing money’ but outliving it.

When discussing whether we could afford my ceasing full time work; the consideration was not how much money we had but how much income we needed. We looked at the three assets available, cash, property and shares, considered their income prospects both present and future, and opted for shares.

The income they generated would meet our immediate needs without having to rely on selling thus maintaining the integrity of our asset base. Also, over the long term I knew that the dividends from a diversified portfolio of shares had and would grow in a relatively stable way and, being linked to the productive efforts of the nation, they would be superior to the income from other sources.

With more than a decade behind us now and the GFC to add some spice we can now look at our strategy being tested in real time. As painful as it was to watch our portfolio almost halve in value, the income only dropped by 20%. As we held enough in cash to cover 2 years pension withdrawals we simply followed our parents example who, when times were tough, simply tightened their belts.

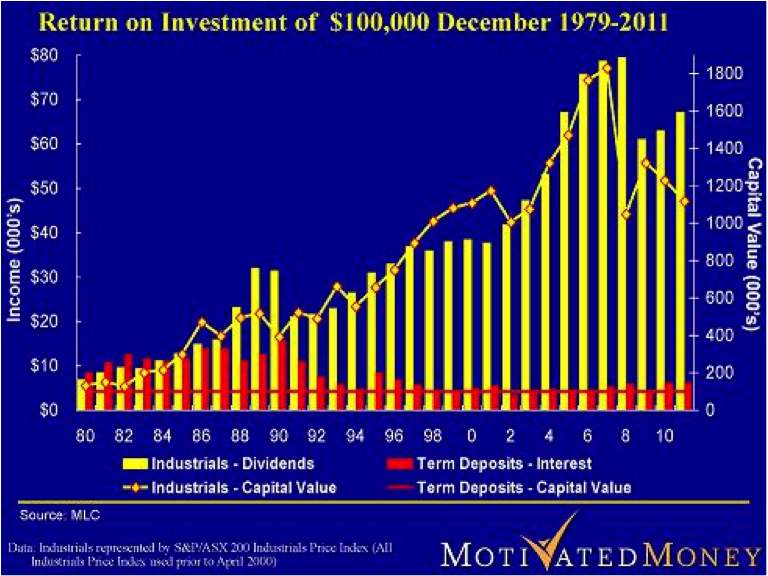

The chart below is worth a thousand words. The dividends, during the 80’s and 90’s whilst I was still working, were being reinvested. When I quit the industry in 2000 it was simply a matter of redirecting the dividend stream from reinvestment to pension mode.

Two years later and our income is almost back to where it was although the portfolio value still hasn’t recovered fully. The importance of never having to rely on cashing your asset base to provide income cannot be impressed enough. Too many retire with too little, too early and leave themselves exposed to the disaster that is cashing in assets when prices have retreated.

By focussing only on the income and not the prices of our shares we have avoided much of the angst associated with the GFC. Also, as longevity appears to be a genetic advantage that we enjoy I need to be sure that the asset base remains intact and the income stream continues to grow for the next few decades.

The fallacy of ‘safe’ cash deposits is highlighted in the chart. My parent’s income was represented by the red bars whilst their cost of living and health care was represented by the yellow bars. We watched as my parents, in-laws and many of their peers were reduced to living totally on the old age pension because they had initially relied on bank deposits in what they thought was the ‘safe’ option.

The proverbial ‘nail in the coffin’ as far as I was concerned was watching as the two respective family homes were sold as neither widow (the husbands having pre-deceased their spouses) could afford to maintain them. The tragedy isn’t over for a number of my mother’s peer group who have held on to their homes. They live in the worst kind of poverty attempting to maintain a liability to satisfy a misguided wish to pass something to the next generation who, I believe, need and deserve nothing!

As the probability is that my wife will survive me; we will continue to invest solely in shares, the conservative option, as I am determined that she will live with dignity.” – Peter Thornhill

Luke Rathborne, Director, Fortitude Private Wealth