Well what a week it has been here in Sydney with the horrific siege at Martin Place last Monday. It’s another timely reminder of how factors outside our control can shake our lives, but also of how lucky we all are to live in such a great country with great compassion, spirit and resolve. Our thoughts go out to the families and friends of innocent victims Katrina and Tori … so very sad.

From a share market’s perspective, despite the usual volatility we see and expect in shares, the market this calendar YTD is basically flat point to point (from Jan 1 to today), being up 2% including dividends based on the ASX200 Accum Index. This follows on from 20% total returns including dividends in each of the 2 proceeding calendar years so the pause in share market growth should be expected. Furthermore, this pausing is appropriate if we are to see a continuation in the long term growth in the market to eventually exceed the pre GFC highs. Reminder, this has been the slowest recovery from previous highs in history for the All Ords (see chart below to 30 Sept 14 .. Source: Fidelity Investments).

With 3 year Govt Bonds at 2.18%pa and the RBA cash rate at 2.5% (and to remain low ‘for some time yet’ as per RBA Governor, Glenn Stevens), this remains for mine a very supportive environment for well-run quality businesses with quality balance sheets and good ‘economic moats’, especially when you can get sustainable grossed up income streams from quality ASX listed companies at over 6%pa currently … and a growing income stream too!

If you have a spare 5-7 minutes, please click here for BKI’s Dec qtr note released yesterday packed with useful wisdom from Will and Tom to help us stay the course. It really is beautifully written Will. Warren Buffett would be proud to be quoted.

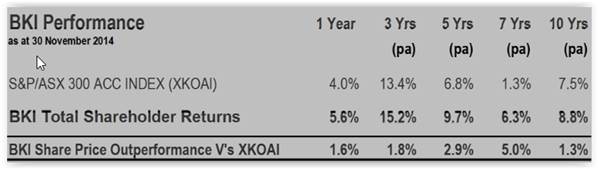

We thank them and all our preferred traditional LIC’s for another great year of fully franked dividend growth and share price outperformance….. ‘TERRIFIC’!!

Finally, on behalf of Emmanuel, Fletcher and myself, thank you all for choosing Fortitude to assist in managing your family’s financial affairs. It is a privilege to work with you all, and one we do not take for granted. We look forward to working with you for many years to come. May you have a fabulous holiday season and another healthy and prosperous year in 2015.